Halftime for 2022

Reflecting on the past six months

Back in January, I wrote about my investment portfolio and explained some of my methodology. It’s been… an interesting six months since then?

Inflation, rising interest rates, Russia’s invasion of Ukraine, an energy crunch, China’s “zero Covid” policy shutdowns, supply chain chaos - everywhere you look there seems to be an “unprecedented” confluence of events. Bloomberg’s Joe Weisenthal and Tracy Alloway - co-hosts of one of my favorite podcasts: Odd Lots - even outlined thirteen “perfect storms” resulting from all the upheaval.

As we move into the second half of 2022, it’s a great time to reflect on investment decisions and lessons learned so far this year.

It’s Going Down

Let’s start with reviewing what’s happened in the markets. It’s pretty tough to find many asset classes performing well…

Stocks

The S&P 500 is down over 19% year to date. And this was the worst start to a year for the Nasdaq Composite since 1985 (mainly technology companies).

Treasuries

Normally, if someone told you the S&P 500 and Nasdaq had performed so poorly, you’d assume US treasuries had served as a safe haven. That’s been a pretty safe bet for decades now - stocks and bonds balance your portfolio… Welp, it turns out the 10yr Treasury hasn’t dropped this much to start a year since 1788!

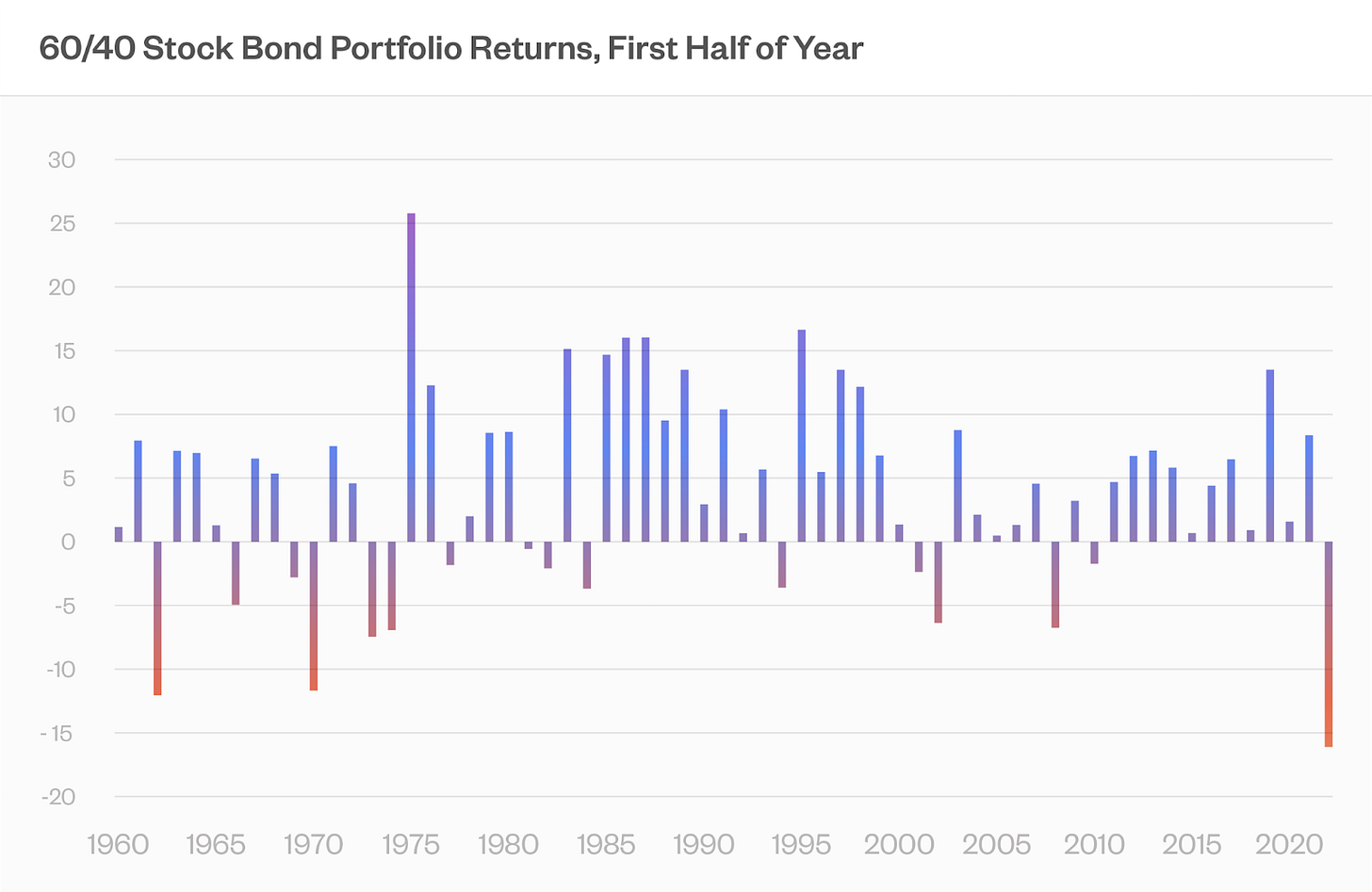

60/40 Portfolio

Put this all together and you get a nasty start to the year for the traditional 60/40 Portfolio, consisting of 60% stocks and 40% bonds.

Commodities

But hey, maybe you were one of the rare investors with exposure to commodities like oil, wheat, natural gas, or nickel? Bloomberg’s commodity index (BCOM) had jumped 36% by early June - though by mid-July that had fallen back a still respectable +12% for the year.

Lesson 1: Crypto Giveth and Taketh Away

And taketh some more.

First, a clarification. The term “crypto” encompasses thousands (hundreds of thousands?) of tokens and coins, 99.9% of which can be easily placed in the joke bin (at best) or classified as a pure Ponzi scheme. Within that remaining 0.1%, I perhaps naively believe there are blockchains with legitimate use cases and potential - Bitcoin, Ethereum, Solana. Time will tell if they turn out to be really cool solutions without a problem to solve.

Those three are down between 58% and 81% YTD. Yikes! They are essentially high beta tech stocks at this point in time. Bitcoin’s thesis as an inflation hedge or as digital gold hasn’t worked out like expected so far…

I continue to hold through this crypto winter. Great practice for riding through extreme volatility!

Lesson 2: Boomer Rocks

Back in January and February I started incorporating Boomer Rocks (you may know this as “gold”) into my non-retirement portfolio. I had some minimal exposure via the Global Asset Allocations ($GAA), but decided it would be a good diversifier.

For now, let’s just say I have a healthy skepticism about global debt levels and think it’s reasonable to assume gold could be a more valuable asset in the coming years as a result. (Thanks Ray Dalio and Peter Zeihan)

If you had told me inflation would be consistently hitting 7-9%, I would have assumed gold had done well. But no, using the iShares Gold Trust ($IAU) as a proxy, gold is down almost -6%. Which leads me to my next lesson.

Lesson 3: Different Types of Inflation

Inflation = prices go up. Right, got it. But why did prices go up?

Harbor Capital launched a (timely) new ETF - Harbor All Weather Inflation Focus $HGER - in February aiming to solve this for investors. As they explained on this Animal Spirits podcast there are different types of inflation, such as commodity scarcity and currency debasement.

To counter this, within their ETF they actively massage the underlying holdings across commodities and precious metals based on the type of inflation they anticipate. It’s a more efficient approach for retail investors - for example, instead of allocating 5% to commodities and 5% to precious metals in your portfolio, you could allocate 7% to $HGER and let Harbor Capital actively manage the holdings. That frees up 3% of your portfolio for a different asset class. And you can’t stop trying to predict the future!

Lesson 4: Hooray Fundrise

Real estate has been on a wild ride. Home builders and mortgage origination companies have had a hard time, not to mention real estate technology companies like Zillow and Redfin.

And yet, Fundrise is actually up 6.2% this year (at least for my ’aggressive’ allocation). Their bread and butter is “build to rent” single family home communities in the Sunbelt, which the CEO has emphasized are two megatrends fueled by the work from anywhere revolution.

On a recent Animal Spirits podcast, he pointed to record flows into Fundrise as a recognition that investors are looking for ‘real assets’ during this time of high inflation. But whereas home builders are heavily impacted by rising mortgage rates, expensive/reduced labor supply, and higher materials costs, Fundrise’s existing rental communities are minimally impacted by those three headwinds. It’s a more sustainable and less cyclical business model.

One important characteristic (advantage?) of private markets is that they only mark-to-market periodically, usually quarterly. Whereas stock prices and crypto are updated constantly throughout a single day, an investment like Fundrise is much less frequent. This disguises its volatility, since you only find out the price every few months, which can make it easier to hold on to.

Lesson 5: Automation is my Friend

Having the majority of my investments on autopilot protects me from impulsive decisions. M1, Fundrise, I-Bonds - with automatic withdrawals, I’m following my plan regardless of the swings in the market. I know myself well enough to recognize I’d probably deviate from this if I had to click ‘buy’ regularly.

Quote

“The quicker you want something, the easier you are to manipulate” - Shane Parrish

Stay patient out there!