What do you think about money?

Start with the fundamentals.

I just finished reading “The Psychology of Money” by Morgan Housel - it’s definitely one of the first books I’d recommend for anyone trying to get a handle on their finances, reassess their approach to investing, or simply learn more about common money biases we all exhibit.

There are no equations, discussions of Traditional vs Roth 401ks, rent vs buy recommendations. Instead, it addresses how we think about money, pursue wealth, evaluate risk… foundational topics. The author weaves all 20 chapters together into a consistent framework for approaching personal finance and life more generally.

Here are a few of my top takeaways.

Luck and Risk

“Luck and risk are siblings. They are both the reality that every outcome in life is guided by forces other than individual effort.”

This is key to how we view both ourselves and others. Two people with the same skill level and level of effort can end up in very different outcomes for reasons totally uncontrollable by each individual. This is not to say skill and effort don’t matter - they’re just not the only inputs in the formula for success.

I’m proud of my career success. It took a lot of hard work, sacrifices, and persistence to get to this point. But I also acknowledge there are many factors beyond my control that put me in a position to succeed - many factors that I take for granted.

In addition, when other people experience failure we naturally tend to view it due to bad decisions. If we make the same mistake, it is due to being unlucky or falling on the wrong side of the risk equation.

Takeaway: Practice humility with success and grace with failure.

Never Enough

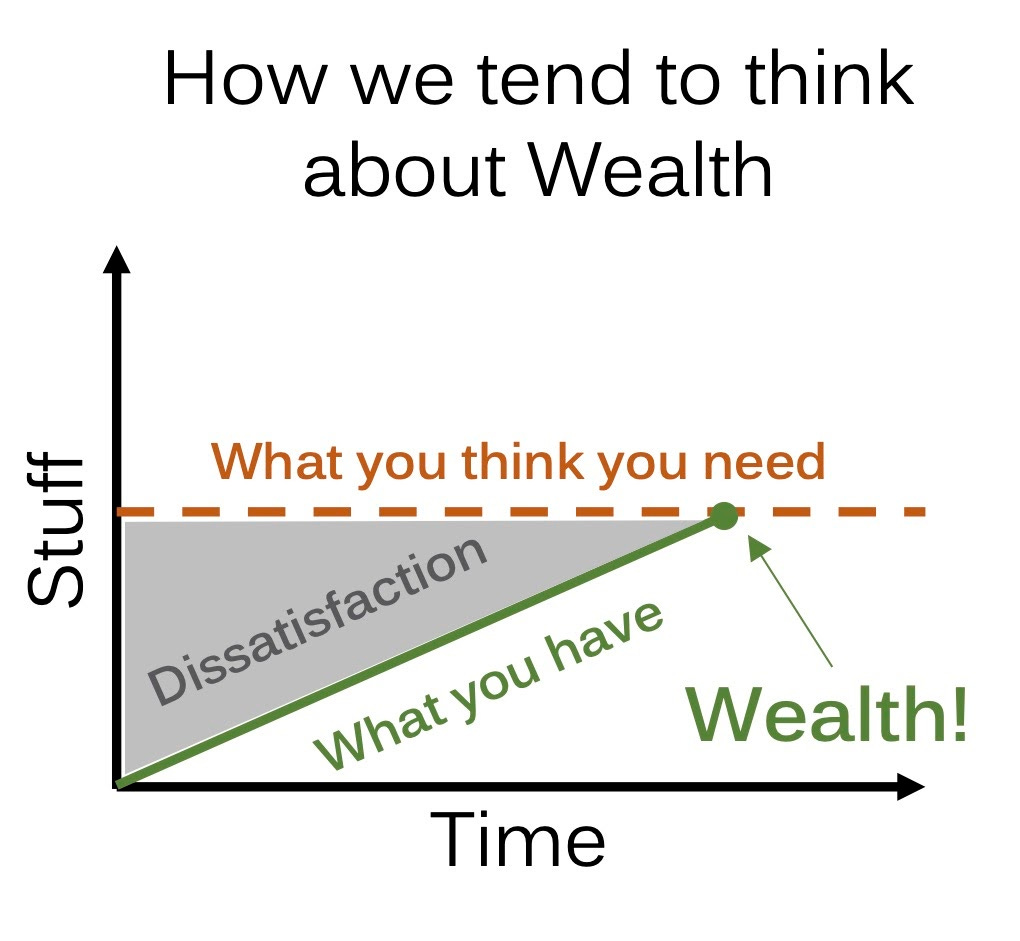

“The hardest financial skill is getting the goalpost to stop moving.”

“Past a certain level of income, what you need is just what sits below your ego… Think of it like this, and one of the most powerful ways to increase your savings isn’t to raise your income. It’s to raise your humility.”

The more success we experience, the more money we make, the higher up the career ladder we climb… it all tends to push contentment further and further away. Always just out of reach. It’s critical to define this problem and recognize it in ourselves. I certainly haven’t figured it out yet.

I recently came across the following illustrations of this concept on Twitter:

It’s not often that you find a personal finance book advocating “raise your humility” as a solution. Not easy to implement, but something I aspire to.

Takeaway: Discontentment is our natural tendency and the solution is not more stuff, more $, more success… These things aren’t ‘wrong’, but they won’t satisfy.

Compounding

“But good investing isn’t necessarily about earning the highest returns, because the highest returns tend to be one-off hits that can’t be repeated. It’s about earning pretty good returns that you can stick with and which can be repeated for the longest period of time. That’s when compounding runs wild.”

Our natural tendency is to think in a linear fashion. But our world is full of examples where ideas spread and technological developments grow exponentially.

We’re also surrounded by articles like “I invested in Dogecoin and I’m now a millionaire!” or “If you’d invested in X tech stock you’d have a 10x return.” Those feed into narratives where people all around us must be hitting investing home runs.

But you don’t have to hit home runs to build wealth. Consistently hitting singles and doubles over a long period of time allows compounding to do its thing. (Did I just use a baseball analogy? Who am I?)

Takeaway: Trust in the magical math of compounding. Consistent, steady investing over a long period of time can produce amazing results.

Room for Error and Survival

“The trick when dealing with failure is arranging your financial life in a way that a bad investment here and a missed financial goal there won’t wipe you out so you can keep playing until the odds fall in your favor.”

“The idea is that you have to take risks to get ahead, but no risk that can wipe you out is ever worth taking. The odds are in your favor when playing Russian roulette. But the downside is not worth the potential upside. There is no margin of safety that can compensate for the risk.”

Sometimes we think we’ve identified investment options that have enormous upside. And maybe we did! The allure of becoming an overnight millionaire is strong. Unfortunately, these options tend to have enormous downsides too. We get impatient and overlook the wipeout potential. These are big setbacks that interrupt the magical math of compounding.

Of course we have to take risks in our investments. But we must maintain this “room for error” so we can survive for the long term.

Takeaway: Be patient and cautiously optimistic with a focus on the long term.

Flexibility

“A hyper-connected world means the talent pool you compete in has gone from hundreds or thousands spanning your town to millions or billions spanning the globe… Intelligence is not a reliable advantage in a world that’s become as connected as our has… competitive advantages tilt toward nuanced and soft skills - like communication, empathy, and, perhaps, most of all, flexibility.”

Wow. You could write a book on just this one concept.

The internet, remote work, increasingly digitized jobs… all of it is opening up who can fill these jobs. I find this amazing and encouraging from a global progress perspective. But personally? Let’s just say it's a big, healthy dose of paranoia - how do I retain a competitive edge?

I like to think I’m a pretty decent data analyst. A great way to cast doubt on that is to recruit for another data analyst and see the competition from around the world! In my opinion, it’s only a matter of time until this global workforce becomes more commonplace in the very roles I’ve filled in my career.

Financially, the idea is that savings don’t have to be for a specific item - for example, a house, car, vacation. That’s fine to do, of course. More importantly, we should be saving simply for the flexibility it provides in an ever-changing world.

Takeaway: Flexibility can be my competitive edge. Save today to increase my options for tomorrow.

Final thoughts

Every chapter of this book deserves attention, but at some point it will be more efficient for you to read the book! Link below.

Reading through this book, taking notes, and writing down my takeaways has given me more clarity around the “why” behind personal finance. I learning about different investment ideas, listening to finance podcasts, etc. Having read this book, I next plan to take a step back and establish my own guiding principles

Enjoy! The Psychology of Money

I'd like to understand more how to get the "what you think you need" line to trend down!