Favorite ETFs - January 2024

Funds I use in my accounts

I first realized personal finance was one of my hobbies when my wife asked why I was listening to a podcast about ETFs - apparently that’s not normal?

ETFs (Exchange Traded Funds) are like mutual funds, but can be traded like stocks throughout the day. They each track an index - for example, SPY 0.00%↑ tracks the S&P 500. However, many investment firms simply create their own index to reflect their investing style and then create an ETF to track that custom index.

With these ETFs we can generate endless combinations and weightings in search of the Perfect Portfolio.

With that said, here are my favorite ETFs that I personally use.

Global Asset Allocation (GAA) - GAA 0.00%↑

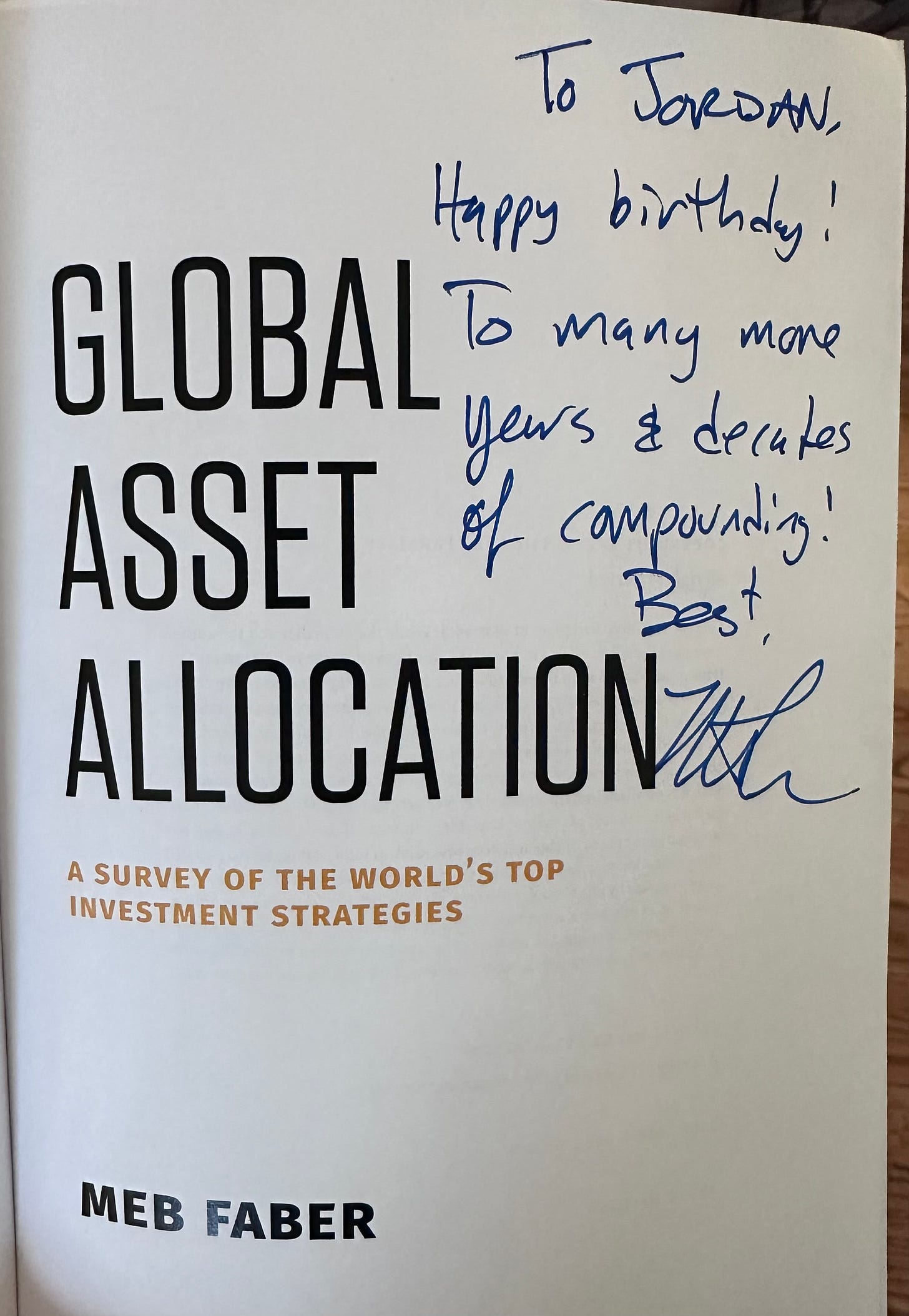

Meb Faber’s podcast was my primary gateway into learning about investing. His book “Global Asset Allocation” introduced me to a variety of portfolio designs, while also explaining how to evaluate them beyond simply looking at a portfolio’s average returns.

Back to the ETF. The Global Asset Allocation ETF is actually an “ETF of ETFs” composed of ~29 underlying ETFs. Most of these are funds from Cambria and Vanguard.

It’s a one-click diversified portfolio actively managed by Cambria. The goal is to “reflect the global universe of assets consisting of domestic and foreign stocks, bonds, real estate, commodities and currencies.” The target weightings are: 45% equities, 45% fixed income, 10% other assets (commodities, currencies, real estate, alternative).

A great “set it and forget it” approach for investors. I used this fund primarily early in my investing journey. Now I prefer to design my own portfolio of ETFs, but I still hold this in my accounts and reference it frequently.

JPMorgan Ultra-Short Income - JPST 0.00%↑

The JPST actively managed fund invests in US treasuries, corporate bonds, and more, that are maturing within one year. This “ultra-short“ focus limits the interest rate sensitivity that longer-term fixed income options experience.

This is my cash-like “savings account” fund.

Avantis US Small Cap Value - AVUV 0.00%↑

Avantis is an investment firm spun up by former Dimensional Fund Advisors executives and reflects many of Dimensional’s same investing approaches - in particular, an affinity for Small Cap Value.

What is Small Cap Value?

‘Small Cap’ refers to the size of a company as measured by its market capitalization. Typically, market capitalization is broken down into mega, large, mid, small, and micro cap categories.

There is no single definition of ‘Value’ investing, but the general goal is identifying companies trading at less than their ‘intrinsic’ value. In other words, the companies are underpriced, at least according to traditional metrics such as price-to-earnings and book value.

Avantis describes their Value approach as “low valuations with higher profitability ratios.” This “higher profitability” helps screen out junk companies - in other words, companies that are obviously cheap for a reason!

Will Small Cap Value prove to outperform in the years ahead? Who knows, but I’m along for the ride.

Global Upstream Natural Resources Index Fund - GUNR 0.00%↑

This unique fund invests in “global companies that operate, manage or produce natural resources in energy, agriculture, metals, timber or water.”1 It’s one avenue to gaining exposure to commodities that tend to correlate with inflation, as opposed to investing in the physical commodities or related futures contracts.

This is a small (and very likely unnecessary) portion of my own portfolio, but I conceptually like the idea of getting commodities exposure while maintaining the higher upside of owning stocks.

iMGP DBi Managed Futures Strategy ETF - DBMF 0.00%↑

If you’re still here after learning about the GUNR ETF, let’s keep this party going with managed futures.

This is an asset class most traditional retail investors ignore, but it can provide an extremely valuable uncorrelated return stream to pair with stocks and bonds. Until the past few years, it was also a difficult asset to access. With the launch of funds like DBMF that’s changing.

What exactly are managed futures?

Investopedia: “A futures contract is a legal agreement to buy or sell a particular commodity asset, or security at a predetermined price at a specified time in the future. Futures contracts are standardized for quality and quantity to facilitate trading on a futures exchange.”

DBMF trades in these futures contracts in equity, bond, currency, and commodities markets. And they can go long or short on these contracts - “long” means you gain if the asset’s price appreciates, while “short” means you gain if the asset’s price declines.

While most traditional investing approaches use a combination of stocks and bonds, managed futures provides values as a third, uncorrelated asset - this can reduce the volatility of a portfolio and allow for smoother compounding.

Quote to Share

Portfolio design is a creative endeavor - an art and a science - that rewards curiosity.

“There are not more than five musical notes, yet the combinations of these five give rise to more melodies than can ever be heard. There are not more than five primary colours, yet in combination they produce more hues than can ever been seen. There are not more than five cardinal tastes, yet combinations of them yield more flavours than can ever be tasted.”

Sun Tzu

https://www.etf.com/GUNR